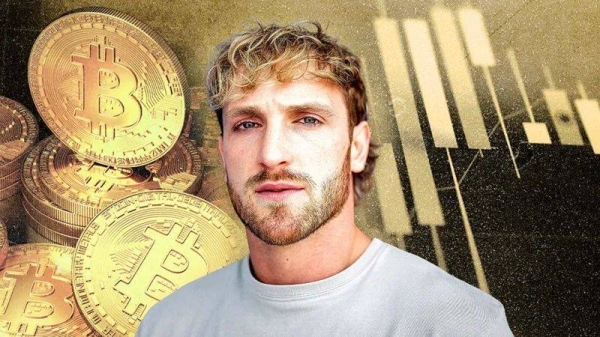

YouTube star and boxer Logan Paul has found himself embroiled in controversy once again, this time over his promotion of cryptocurrencies.

Paul, known for his outspoken personality and often controversial behavior, has been accused of misleading fans and followers into investing in cryptocurrencies without full disclosure of potential risks. Critics argue that he has used his significant influence to promote specific cryptocurrencies, often without adequate knowledge or expertise.

The allegations stem from a series of videos and social media posts where Paul has enthusiastically endorsed various cryptocurrencies, including Dogecoin and CryptoZoo. In some instances, he has been accused of promoting “pump and dump” schemes, where the value of a cryptocurrency is artificially inflated before being sold off by insiders.

The SEC’s Involvement

The U.S. Securities and Exchange Commission (SEC) has increased its scrutiny of celebrity endorsements of cryptocurrencies, particularly those that may be considered securities. The SEC has warned that celebrities who promote cryptocurrencies without disclosing their compensation or the risks involved could face legal action.

The Impact on Fans and the Crypto Community

The controversy surrounding Logan Paul’s crypto promotions has raised concerns about the potential harm to his fans, many of whom may be young and inexperienced investors. Critics argue that Paul’s influence could lead fans to make impulsive and risky investment decisions without fully understanding the consequences.

The crypto community itself has also been divided over the issue. While some have defended Paul’s right to free speech and his ability to promote whatever he chooses, others have criticized his actions as irresponsible and unethical.

As the crypto industry continues to evolve, it’s crucial for influencers and celebrities to be transparent about their financial interests and to avoid misleading their followers. The SEC’s increased scrutiny of celebrity endorsements is a step in the right direction, but more needs to be done to protect investors from potential harm.